Keajaiban Slot Maxwin Paling Gacor Sakong88 – Sakong88 telah menjadi pusat perhatian bagi para penggemar judi slot online yang mencari kegembiraan dan kesempatan untuk meraih kemenangan besar. Dikenal sebagai salah satu destinasi terbaik untuk slot maxwin yang paling gacor. Sakong88 menawarkan pengalaman bermain yang menghibur dan menguntungkan bagi para pemainnya.

3 Keunggulan Agen Slot Sakong88

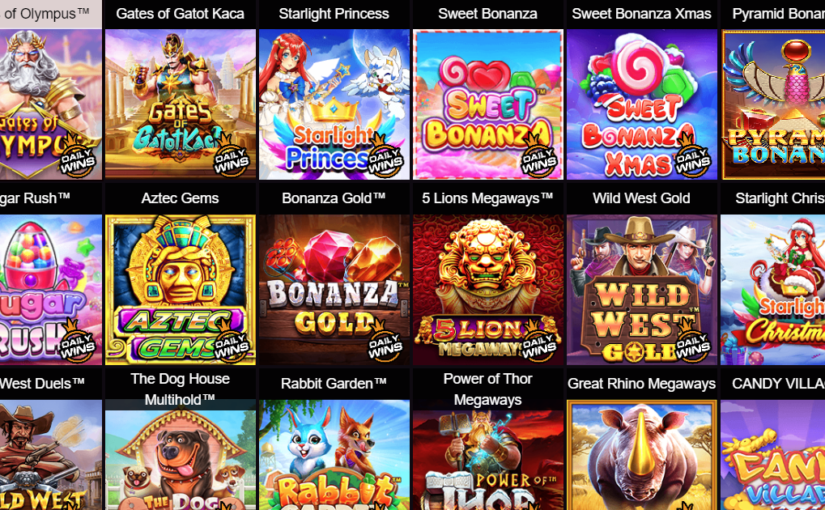

- Koleksi Slot Terlengkap: Sakong88 menawarkan koleksi slot terlengkap dengan berbagai pilihan permainan dari penyedia terkemuka di industri. Dari slot klasik hingga yang paling inovatif, setiap pemain dapat menemukan permainan yang sesuai dengan selera dan preferensinya.

- Slot Maxwin Gacor: Salah satu fitur unggulan Sakong88 adalah slot maxwin yang paling gacor. Dengan RTP tinggi dan potensi untuk meraih kemenangan besar, slot ini menjadi favorit di antara para pemain judi online yang mencari keuntungan maksimal.

- Jackpot Menggiurkan: Sakong88 juga menawarkan jackpot yang menggiurkan dengan hadiah besar yang dapat mengubah hidup para pemenangnya. Dengan peluang untuk memenangkan jackpot yang besar, setiap putaran di Sakong88 penuh dengan potensi keberuntungan.

3 Tips Bermain Slot Sakong88

- Pilih Slot dengan RTP Tinggi: Sebelum memulai bermain, pastikan untuk memilih slot dengan RTP tinggi untuk meningkatkan peluang kemenangan Anda.

- Manfaatkan Bonus dan Promosi: Sakong88 sering kali menawarkan bonus dan promosi menarik kepada para pemainnya. Manfaatkan kesempatan ini untuk meningkatkan modal Anda dan memperbesar peluang kemenangan Anda.

- Kelola Modal dengan Bijak: Tetapkan batasan modal yang jelas sebelum memulai bermain dan patuhi aturannya. Jangan tergoda untuk bertaruh lebih dari yang Anda mampu.

Daftar 3 Slot Unggulan Situs Sakong88

- Book of Ra: Slot petualangan yang menarik ini menampilkan fitur putaran gratis yang mengasyikkan dan potensi untuk memenangkan hadiah besar dengan simbol khusus yang dapat memperluas gulungan.

- Gonzo’s Quest: Slot dengan tema petualangan ini menawarkan grafis yang mengagumkan dan fitur Avalanche yang unik, di mana simbol-simbol jatuh ke posisi baru setiap kali Anda menang.

- Mega Fortune: Slot progresif yang terkenal ini menawarkan jackpot progresif yang terus bertambah hingga seseorang berhasil memenangkannya. Dengan hadiah yang bisa mencapai jutaan dolar, Mega Fortune menjadi daya tarik utama di Sakong88.